Ira distribution tax calculator

Account balance as of December 31 2021. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year.

Retirement Withdrawal Calculator For Excel

All Social Security retirement income can be subtracted from your taxable income when you file your North Carolina income tax return.

. A resident of Kentucky for example can include IRA withdrawals within the. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

For married couples filing jointly the tax brackets are. Roth IRA Distribution Details. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Required Minimum Distribution Calculator. Visit The Official Edward Jones Site.

Visit The Official Edward Jones Site. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. Since you took the withdrawal before you reached age 59 12 unless you met one.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. But state tax laws may differ on whether IRA distributions can be counted as retirement income. Are other forms of retirement income taxable in North.

This tool is intended to show the tax treatment of distributions from a Roth IRA. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Contributions for a given tax year can be made to a Roth IRA up until taxes are filed in April of the next year.

Ad Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. That is it will show which amounts will be subject to ordinary income tax andor.

Direct contributions can be withdrawn tax-free and. Your life expectancy factor is taken from the IRS. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. How is my RMD calculated. Subtracting this from 1 gives 085 for the taxable portion of the account.

Roth IRA Distribution Tool. Calculate your earnings and more. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. New Look At Your Financial Strategy. Ad Use This Calculator to Determine Your Required Minimum Distribution.

Plug in the amount of money youd like to take home. New Look At Your Financial Strategy. Our Colorado retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

If you decide to withdraw 10000 multiplying by 085 gives a taxable IRA withdrawal amount of. This means your taxable IRA withdrawal will be taxed at 24 percent. 10 percent for income between 0 and 19050.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Canadian Foreign Tax Credit On Ira Distribution

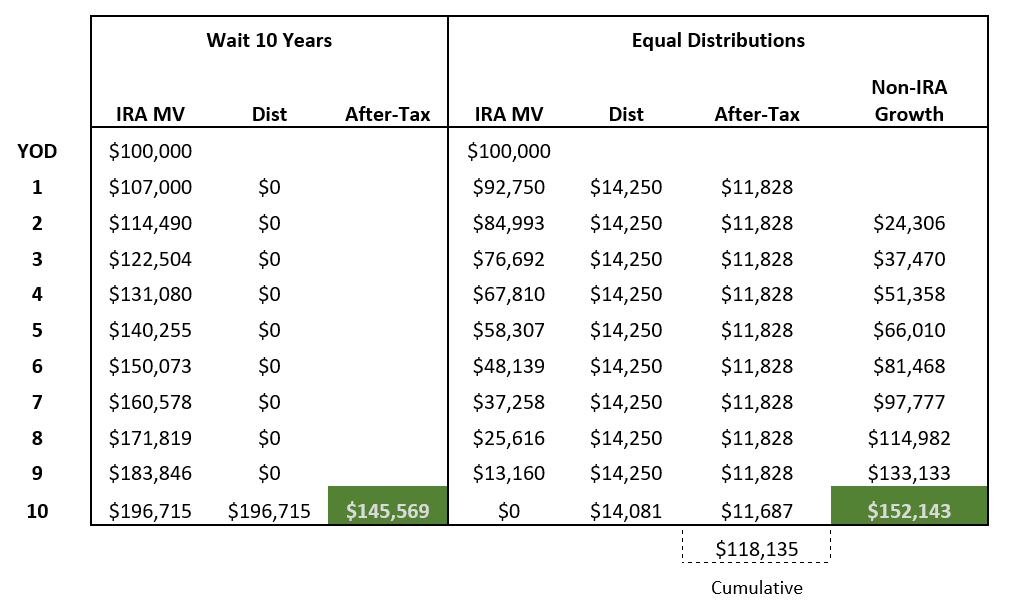

Understanding The Secure Act Managing The 10 Year Rule Financial Planning Insights Manning Napier

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Traditional Vs Roth Ira Calculator

Retirement Income Calculator Faq

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Evaluate Your Current Vs Future Marginal Tax Rate