Self employed 401k calculator

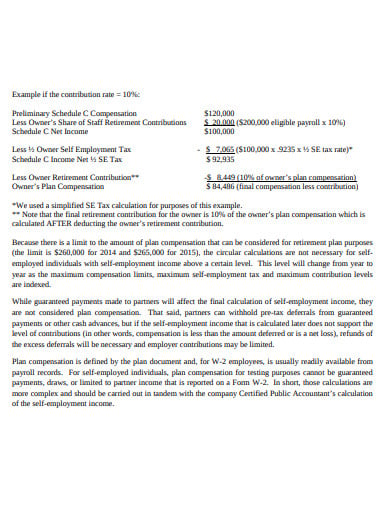

Enter your name age and income and then click Calculate The. You cant simply multiply your net profit on Schedule C by.

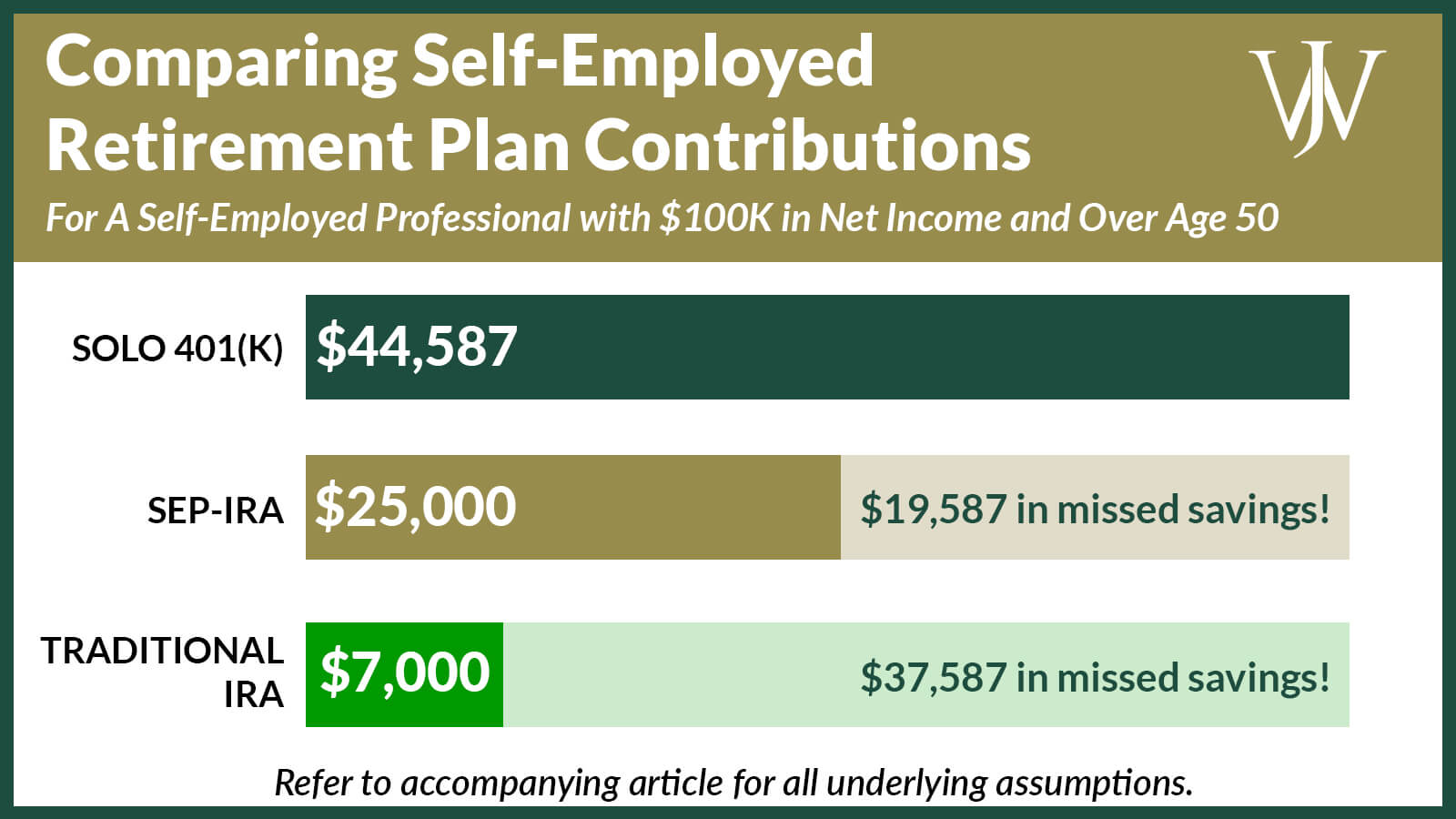

Solo 401k Contribution Limits And Types

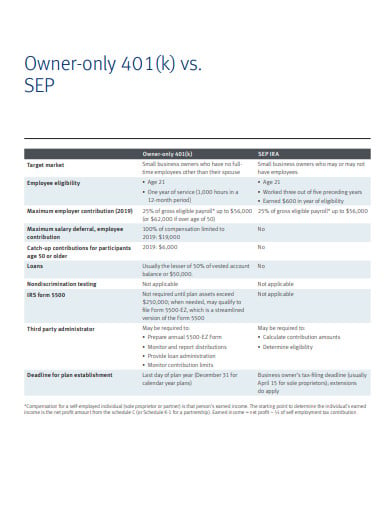

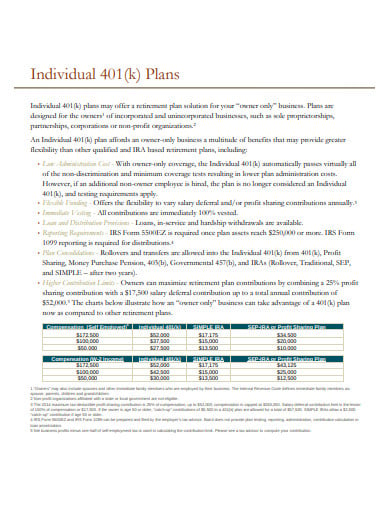

Self-employed individuals owner-only businesses and partnerships can save more for retirement through a 401 k plan designed especially for you.

. In Just 3 Minutes Get Your Personalized Retirement Savings Action Plan. Reviews Trusted by Over 45000000. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Self Employed 401k SEP IRA Defined Benefit Plan or.

Compare 2022s Best Gold IRAs from Top Providers. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings. This formula works to determine employees allocations but your own contributions are more complicated.

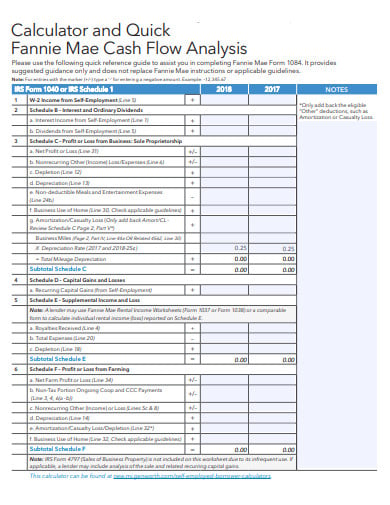

One-half of your self-employment tax and contributions for yourself. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Use the rate table or worksheets in Chapter 5 of IRS Publication 560 Retirement Plans for Small Business.

Part I Calculate Your Adjusted Net Business Profits 1. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. In this self-employed 401k contribution calculator you can get the general information of what you need to know before you start investing in this saving option.

If your business is an S-corp C-corp or LLC taxed as such. You can download this sample. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual 401 k SIMPLE IRA or SEP-IRA.

The solo 401 k can. Solo 401 k Contribution Calculator As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee. Solo 401k Retirement Calculator A Solo 401k can be one of the best tools for the self-employed to create a secure retirement.

Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA. Ad Get Personalized Action Items of What Your Financial Future Might Look Like. A Solo 401k also referred to as a Uni k Solo k one participant 401k and an individual 401k can be a valuable wealth-building tool for the self-employed.

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. Self-employed 401 k calculator - individual 401 k contributions Calculate your earnings and more Self-employed individuals and businesses employing only the owner partners and.

Self-Employment Tax Deduction 2. Supplementing your 401k or IRA with cash value life insurance can help. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

First all contributions and earnings to your Solo 401k are tax. 010000 From Schedule C C-EZ or K-1 2. 7065 From IRS Form 1040.

Business Net Profits 1. Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there.

With Fidelity you have no account fees and. Self Employed 401k Calculator The calculation of how much can be contributed to a Self Employed 401k is based only on the W-2 salary of the self employed business owner business.

Solo 401k Contribution Limits And Types

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Self Employed How To Choose Between A Solo 401 K Sep Ira Retirement Savings

2

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Calculator Solo 401k

How Much Can I Contribute To My Self Employed 401k Plan

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Understanding Solo 401 K After Tax Total Additions Limit For Sole Proprietorship Bogleheads Org

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

How Much Can I Contribute To My Self Employed 401k Plan

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Here S How To Calculate Solo 401 K Contribution Limits